montana sales tax rate 2021

The 775 sales tax rate in Albuquerque consists of 5 New Mexico state sales tax and 275 Albuquerque tax. The Florida state sales tax rate is currently.

Click here for a larger sales tax map or here for a sales tax table.

. Montana has a 675 percent corporate income tax rate. The Hamilton County sales tax rate is. Wayfair Inc affect Missouri.

The Palm Beach County sales tax rate is. Depending on the volume of sales taxes you collect and the status of your sales tax account with New York you may be required to file sales tax returns on a monthly semi-monthly quarterly semi-annual or annual basis. The sales tax jurisdiction name is Bernalillo which may refer to a local government division.

To review the rules in. Additional incentives include electric charging infrastructure tax. California collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

For state use. The Ohio state sales tax rate is 575 and the average OH sales tax after local surtaxes is 71. Special taxes in Montanas resort areas are not included in our analysis.

Montana does not have a state sales tax and does not levy local sales taxes. Which state has the lowest corporate tax rate. State and Local Sales Tax Rates 2021.

Wayfair Inc affect Florida. State and Local Sales Tax Rates Midyear 2020. Exemptions to the Montana sales tax will vary by state.

Counties and cities can charge an additional local sales tax of up to 5125 for a maximum possible combined sales tax of 9355. This page will be updated monthly as new sales tax rates are released. Missouri has 1090 special sales tax jurisdictions with local sales taxes in addition to the state sales tax.

The 2018 United States Supreme Court decision in South Dakota v. Did South Dakota v. The Everett Washington sales tax rate of 99 applies to the following five zip codes.

Over the past year there have been 21 local sales tax rate changes in California. State State Sales Tax Rate Rank Avg. Has impacted many state nexus laws and.

Local Sales Tax Rate a Combined Sales Tax Rate Rank Max Local Sales Tax Rate. The 2018 United States Supreme Court decision in South Dakota v. Montanas tax system ranks 5th overall on our 2022 State Business Tax.

For example Colorado offers a 4000 tax credit through 2021 on the purchase of light-duty EVs and Connecticut allows for a reduced biennial vehicle registration fee of 38 for EVs. There is no state sales tax in Montana. The Tampa sales tax rate is.

A gross receipts tax is a tax applied to a companys gross sales without deductions for a firms business expenses like costs of goods sold and compensation. Click here for a larger sales tax map or here for a sales tax table. The Birmingham sales tax rate is.

Certain businesses located within Urban Enterprise Zones including Salem County are required to only collect a reduced sales tax of 50 the state sales tax rate. Goods and services can be purchased sales-tax-free though sin taxes on alcohol and cigarettes do apply. Compare 2021 state corporate income tax rates and brackets.

Gasoline purchases are not subject to the New Jersey Sales Tax but a Gasoline Excise Tax does apply. ZEV Sales Tax Exemption. Many states allow local governments to charge a local sales tax in addition to the statewide sales tax so the actual sales tax rate may vary by locality within each state.

Counties and cities can charge an additional local sales tax of up to 225 for a maximum possible combined sales tax of 8. Missouri has a lower state. Has impacted many state nexus laws and sales tax collection requirements.

The Kansas City sales tax rate is. An alternative sales tax rate of 105 applies in the tax region Snohomish-Ptba which appertains to zip code 98204. Has impacted many state nexus laws and sales tax collection requirements.

The 2018 United States Supreme Court decision in South Dakota v. In effect that lowers the top capital gains tax rate in Montana from 69 to 49. Items such as groceries household paper products medicine and clothes are exempt from all sales taxes.

The 2018 United States Supreme Court decision in South Dakota v. The Role of Competition in Setting Sales Tax Rate. Did South Dakota v.

Special taxes in Montanas resort areas are not included in our analysis. Has impacted many state nexus laws and sales tax collection requirements. Everything You Need to Know.

TAX DAY IS APRIL 17th - There are 216 days left until taxes are due. Compare 2021 sales tax rates by state with new resource. The Ohio state sales tax rate is currently.

2021 state and local sales tax rates. The credit is equal to 2 of all net capital gains listed on your Montana income tax return. AFV Conversion Tax Credit.

Kansas has state sales tax of 65 and allows local governments to collect a local option sales tax of up to 4There are a total of 529 local tax jurisdictions across the state collecting an average local tax of 1987. To review the rules in Ohio visit our state-by. Did South Dakota v.

Combined with the state sales tax the highest sales tax rate in Hawaii is 45 in the cities of. Choose any state for more information including local and municiple sales tax rates is applicable. This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the modified tax rates apply.

Montana has a graduated individual income tax with rates ranging from 100 percent to 675 percent. The 2018 United States Supreme Court decision in South Dakota v. Has impacted many state nexus laws and sales tax collection requirements.

Californias maximum marginal income tax rate is the 1st highest in the United States ranking directly. Wayfair Inc affect Alabama. To review the rules in.

Hawaii has state sales tax of 4 and allows local governments to collect a local option sales tax of up to 05There are a total of 4 local tax jurisdictions across the state collecting an average local tax of 0431. Ohio has 1424 special sales tax jurisdictions with local sales taxes in addition to the. On this page we have compiled a calendar of all sales tax due dates for New York broken down by filing frequency.

This is the total of state and county sales tax rates. 2021 Capital Gains Tax Rates. There is no applicable county tax or special tax.

How does Montanas tax code compare. Unlike a sales tax a gross receipts. The Missouri state sales tax rate is 423 and the average MO sales tax after local surtaxes is 781.

Combined with the state sales tax the highest sales tax rate in Kansas is 115 in the cities of. Groceries and prescription drugs are exempt from the Ohio sales tax. This is the total of state and county sales tax rates.

Try our FREE income. Combined with the state sales tax the highest sales tax rate in Nevada is 8375 in the cities. The minimum combined 2022 sales tax rate for Palm Beach County Florida is.

Nevada has state sales tax of 46 and allows local governments to collect a local option sales tax of up to 355There are a total of 33 local tax jurisdictions across the state collecting an average local tax of 3366. Montana income tax rates. Start filing your tax return now.

Like the Federal Income Tax Californias income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. Click here for a larger sales tax map or here for a sales tax table. The Montana sales tax rate is 0 as of 2022 and no local sales tax is collected in addition to the MT state tax.

98201 98203 98206 98207 and 98213. An alternative sales tax rate of 106 applies in the tax region Mill Creek which appertains to zip code 98208. Under Montana Code 15-30-2320.

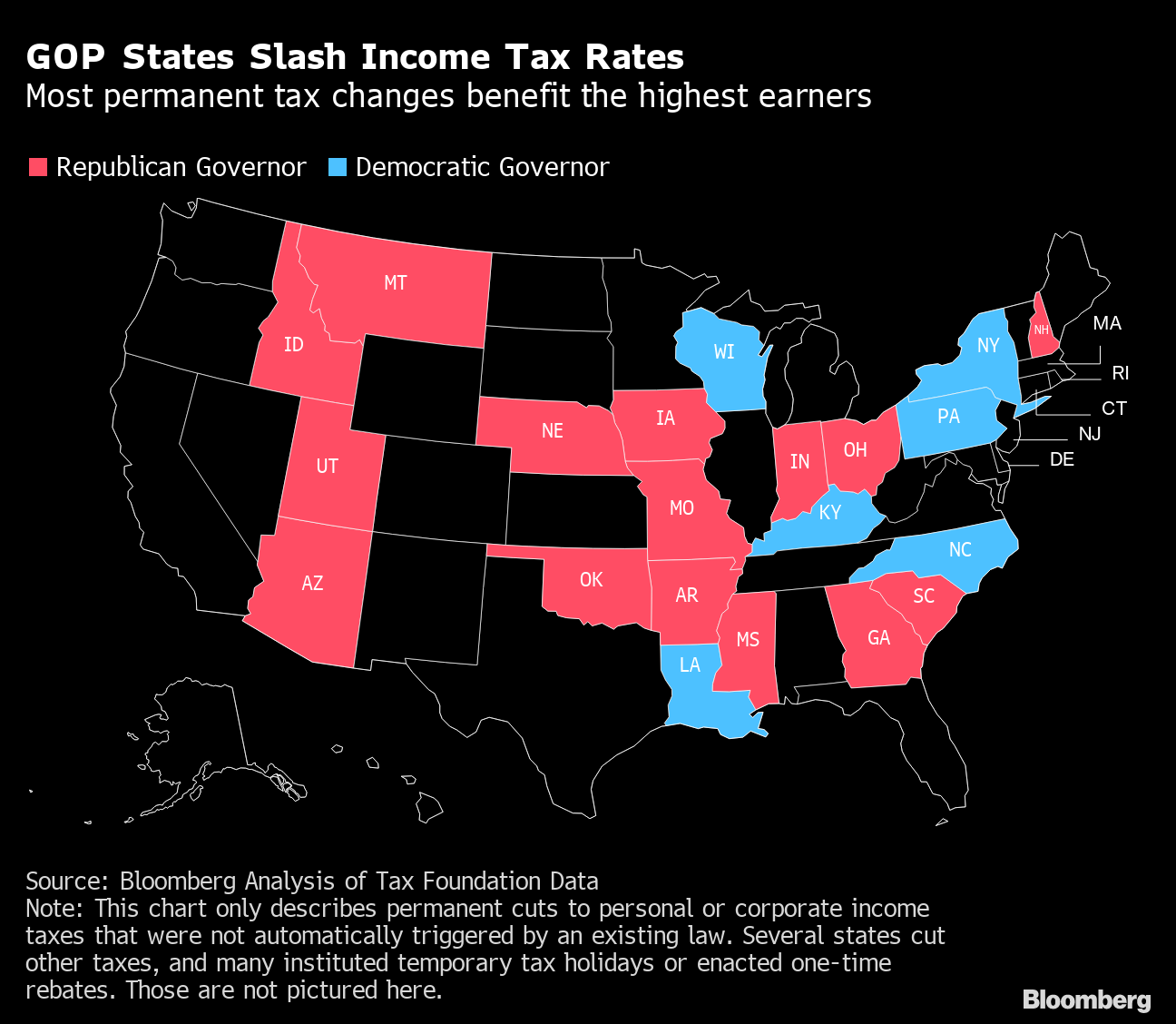

Us States Slash Taxes Most In Decades On Big Budget Surpluses Bloomberg

Tax Policy States With The Highest And Lowest Taxes

How High Are Cell Phone Taxes In Your State Tax Foundation

Tennessee Sales Tax Small Business Guide Truic

Is Buying A Car Tax Deductible Lendingtree

U S States With No Sales Tax Taxjar

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

States Without Sales Tax Article

Madison County Sales Tax Department Madison County Al

State Income Tax Rates Highest Lowest 2021 Changes

How Is Tax Liability Calculated Common Tax Questions Answered

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Tax Rates To Celebrate Gulfshore Business

State Corporate Income Tax Rates And Brackets Tax Foundation

States With The Highest And Lowest And No Sales Tax Rates States With Lowest Local Sales Tax Youtube

Montana State Taxes Tax Types In Montana Income Property Corporate